Kicking off with First-Time Home Buying Tips, this guide is here to help you ace the home buying game like a pro. Get ready to dive into the world of real estate with confidence and savvy moves.

Whether you’re a newbie to the housing market or looking to level up your home buying skills, this guide has got your back with all the essential tips and tricks you need to know.

Importance of Saving for a Down Payment: First-Time Home Buying Tips

Saving for a down payment is a crucial step in the home buying process for first-time buyers. It allows you to secure a mortgage, determine the size of your loan, and impact the interest rates you receive. Without a sufficient down payment, you may face challenges in qualifying for a loan or end up paying higher interest rates.

Strategies to Help First-Time Homebuyers Save for a Down Payment

- Set a savings goal: Determine how much you need for a down payment and create a realistic timeline to reach that goal.

- Automate savings: Set up automatic transfers from your paycheck to a dedicated savings account to ensure consistent contributions.

- Cut back on expenses: Identify areas where you can reduce spending, such as dining out less frequently or canceling subscription services.

- Increase income: Consider taking on a side hustle or freelance work to boost your savings potential.

- Utilize windfalls: Put any unexpected income, such as tax refunds or bonuses, directly into your down payment fund.

Impact of a Larger Down Payment on Mortgage Terms

- Lower monthly payments: A larger down payment means borrowing less money, resulting in lower monthly mortgage payments.

- Improved loan terms: Lenders may offer more favorable terms, such as lower interest rates or reduced private mortgage insurance (PMI) with a larger down payment.

- Equity buildup: A larger down payment means starting with more equity in your home, which can help you build wealth over time.

Understanding Your Budget

When it comes to buying a home, understanding your budget is crucial. It involves more than just the purchase price, as there are additional costs that need to be factored in. Let’s dive into how to calculate a budget and the key factors to consider.

Calculating Your Budget

- Start by determining your total monthly income.

- Calculate all your monthly expenses, including bills, groceries, and other payments.

- Subtract your monthly expenses from your income to see how much you can allocate towards a mortgage payment.

- Consider other financial goals such as savings, emergency fund, and retirement contributions.

Key Factors to Consider

- Down payment: A larger down payment can lower your monthly mortgage payments.

- Debt-to-income ratio: Lenders typically look for a ratio below 43%.

- Credit score: A higher credit score can help you qualify for a better interest rate.

- Interest rates: Keep an eye on current rates to estimate your potential mortgage payments.

Additional Costs to Factor In

- Closing costs: Include fees for appraisal, inspection, and title search.

- Property taxes: Research tax rates in the area you are looking to buy.

- Homeowners insurance: Protect your investment with the right coverage.

- Maintenance and repairs: Budget for unexpected home expenses that may arise.

Researching Mortgage Options

When it comes to buying your first home, researching mortgage options is a crucial step in the process. Understanding the different types of mortgages available for first-time homebuyers can help you make an informed decision that aligns with your financial goals and needs.

Fixed-Rate vs. Adjustable-Rate Mortgages

- Fixed-Rate Mortgages:

- Interest rates remain the same throughout the life of the loan.

- Monthly payments are predictable and stable, making budgeting easier.

- Best for individuals who prefer consistency and plan to stay in their home long-term.

- Adjustable-Rate Mortgages:

- Interest rates can fluctuate after an initial fixed period.

- Initial lower rates may lead to lower initial payments but can increase over time.

- May be suitable for those planning to sell or refinance before rates adjust.

Government-Backed Loans: FHA and VA Loans

- FHA Loans:

- Insured by the Federal Housing Administration.

- Lower down payment requirements (as low as 3.5%).

- Flexible qualification criteria, making it accessible for first-time homebuyers.

- Requires mortgage insurance premiums for the duration of the loan.

- VA Loans:

- Available to eligible veterans, service members, and their families.

- No down payment required in most cases.

- No private mortgage insurance (PMI) needed.

- Competitive interest rates and limited closing costs.

Working with Real Estate Professionals

When it comes to buying your first home, working with real estate professionals can make a huge difference in the process. Real estate agents and mortgage brokers play vital roles in helping you navigate the complexities of the housing market and secure the best deal possible.

The Role of a Real Estate Agent, First-Time Home Buying Tips

Real estate agents are experts in the local housing market and can help you find properties that meet your needs and budget. They guide you through the entire home buying process, from searching for homes to negotiating offers and closing the deal. Their knowledge and experience are invaluable in making sure you make informed decisions every step of the way.

Tips for Selecting a Trustworthy Real Estate Agent

- Look for an agent with a solid track record of successful transactions in your desired area.

- Ask for recommendations from friends, family, or colleagues who have recently bought a home.

- Interview multiple agents to find someone who communicates well and understands your preferences.

- Choose an agent who is responsive, proactive, and has your best interests at heart.

The Benefits of Working with a Mortgage Broker or Lender

Mortgage brokers and lenders help you secure financing for your home purchase. They can offer a variety of loan options and help you find the best interest rates available. Working with a mortgage professional can simplify the loan application process and increase your chances of getting approved for a mortgage that fits your financial situation.

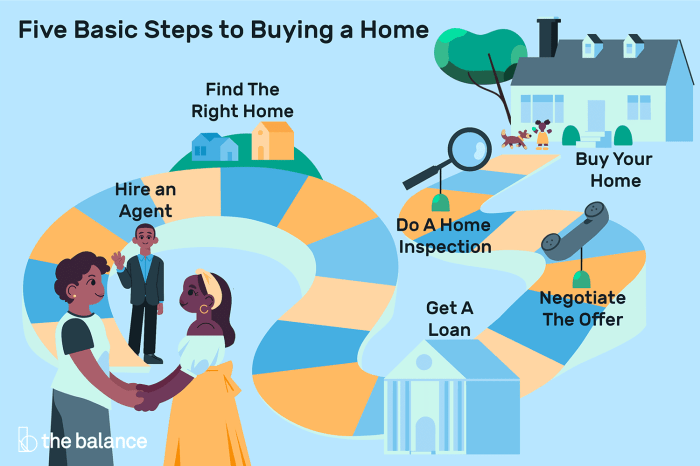

Understanding the Home Buying Process

When it comes to purchasing a home, there are several important steps to consider. From home inspections to closing costs, understanding the entire process is crucial for first-time buyers.

The Importance of a Home Inspection and Appraisal

- A home inspection is a thorough evaluation of the property’s condition, identifying any potential issues that may need to be addressed before finalizing the purchase.

- An appraisal is an assessment of the home’s value by a professional appraiser, ensuring that the property is worth the agreed-upon price.

- Both the inspection and appraisal protect the buyer by ensuring they are making a sound investment and not overpaying for the property.

The Closing Process and Associated Costs

- The closing process involves signing the final paperwork, transferring ownership of the property, and completing the transaction.

- Associated costs may include closing costs, which cover fees for services such as title searches, appraisals, and legal paperwork.

- Other costs may include property taxes, homeowners insurance, and any prepaid interest on the mortgage.

Tips for Choosing the Right Neighborhood

When looking to buy a home, choosing the right neighborhood is crucial. Researching neighborhoods beforehand can help you make an informed decision that fits your lifestyle and future plans.

Factors to Consider When Choosing a Neighborhood

- Look into the quality of schools in the area, especially if you have children or plan to in the future. Good schools can increase the value of your home.

- Consider the amenities available nearby, such as parks, shopping centers, restaurants, and recreational facilities. These can greatly impact your quality of life.

- Check the safety of the neighborhood by looking at crime rates and talking to current residents. Safety is a top priority when choosing where to live.

Assessing Future Resale Value Based on Neighborhood

- Research the trends in property values in the neighborhood. A neighborhood with increasing property values is a good sign for future resale value.

- Consider the location and accessibility of the neighborhood. Proximity to transportation, highways, and popular areas can positively impact resale value.

- Look at the development plans for the neighborhood. New infrastructure, businesses, and amenities can attract buyers in the future.

Homeownership Responsibilities

Owning a home comes with a set of responsibilities that go beyond just paying a mortgage. As a homeowner, you are now in charge of maintenance, repairs, and ongoing costs associated with your property. It’s essential to be prepared for these responsibilities to ensure your home remains in good condition and retains its value over time.

Maintenance Tips for First-Time Homeowners

- Regularly inspect your home for any signs of damage or wear and tear. Addressing issues early can prevent more significant problems down the line.

- Create a maintenance schedule for tasks like cleaning gutters, servicing HVAC systems, and checking for leaks to keep your home in top shape.

- Learn basic DIY skills to handle minor repairs around the house, such as fixing a leaky faucet or replacing a light fixture.

- Invest in tools and equipment needed for home maintenance to save money on hiring professionals for every task.

- Consider setting aside a budget for unexpected repairs or emergencies to avoid financial strain when issues arise.

Budgeting for Ongoing Homeownership Costs

- Include expenses such as property taxes, insurance, utilities, and HOA fees in your monthly budget to avoid financial surprises.

- Plan for regular maintenance costs, such as lawn care, pest control, and minor repairs, to keep your home in good condition.

- Save for larger expenses like roof replacements, appliance upgrades, or major renovations by setting aside a portion of your income each month.

- Review your budget regularly to adjust for any changes in expenses or income, ensuring you can comfortably afford your homeownership costs.

- Consider consulting a financial advisor to help you create a comprehensive budget that accounts for all aspects of homeownership.

Avoiding Common Mistakes

When buying your first home, it’s essential to avoid common mistakes that can cost you time and money. One of the critical steps is getting pre-approved for a mortgage before starting your home search. This helps you understand how much you can afford and shows sellers that you are a serious buyer. Additionally, negotiating the best price and terms for a home is crucial to getting a good deal and ensuring you don’t overspend.

Importance of Getting Pre-Approved for a Mortgage

Before you start looking for your dream home, it’s important to get pre-approved for a mortgage. This involves meeting with a lender to determine how much money you can borrow based on your credit, income, and expenses. Here are some key reasons why getting pre-approved is crucial:

- Know your budget: Getting pre-approved helps you understand your budget and prevents you from falling in love with a home you can’t afford.

- Competitive edge: Sellers are more likely to consider offers from buyers who are pre-approved, giving you a competitive edge in a hot real estate market.

- Faster closing process: Pre-approval speeds up the closing process once you find a home you love, saving you time and hassle.

Tips for Negotiating the Best Price and Terms for a Home

When it comes to negotiating the price and terms of a home purchase, it’s essential to be prepared and strategic. Here are some tips to help you secure the best deal:

- Research the market: Understand the current market conditions in your area to determine a fair price for the home you’re interested in.

- Work with a real estate agent: A skilled agent can help you negotiate with the seller to get the best price and terms for your new home.

- Don’t be afraid to walk away: If the seller isn’t willing to negotiate or meet your terms, be prepared to walk away and find a better deal elsewhere.