Customer Acquisition Cost is a crucial metric in business and marketing, impacting growth and success. Dive into the world of CAC and uncover strategies for optimizing it.

Explore the key elements that influence CAC and learn how businesses can enhance their marketing efforts to reduce costs and boost effectiveness.

What is Customer Acquisition Cost?

Customer Acquisition Cost (CAC) is a metric used by businesses to determine the total cost incurred in acquiring a new customer. This cost includes all expenses related to sales and marketing efforts aimed at attracting and converting new customers.

Importance of Customer Acquisition Cost

Understanding CAC is crucial for businesses as it helps in evaluating the effectiveness of their marketing strategies and the overall health of their business model. By knowing how much it costs to acquire a customer, companies can make informed decisions on resource allocation and budgeting.

- Calculating Customer Acquisition Cost involves dividing the total cost of sales and marketing by the number of new customers acquired during a specific period.

- For example, if a company spent $10,000 on sales and marketing in a month and acquired 100 new customers, the CAC would be $100 per customer ($10,000 / 100).

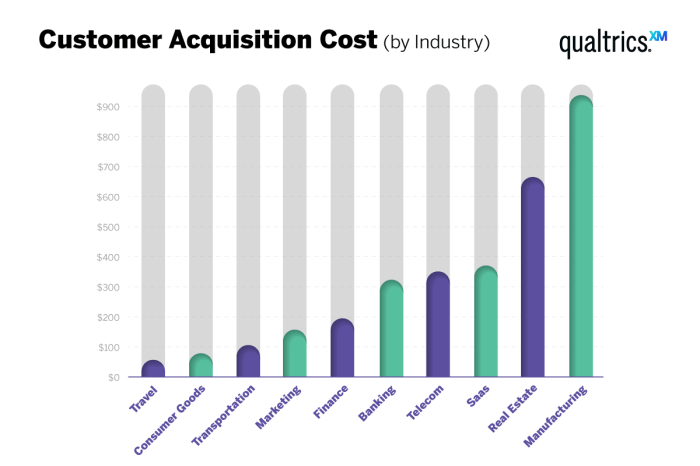

- Different industries may have varying CAC calculations based on the nature of their products or services, target market, and marketing channels used.

Optimizing Customer Acquisition Cost for Business Growth

Optimizing CAC is essential for sustainable business growth as it directly impacts profitability and customer retention. By identifying ways to reduce CAC through efficient marketing campaigns, better targeting, and improved conversion rates, businesses can increase their customer base and revenue streams.

By lowering Customer Acquisition Cost while maintaining customer quality, businesses can improve their return on investment and long-term sustainability.

Factors Influencing Customer Acquisition Cost

When it comes to Customer Acquisition Cost (CAC), several key factors can influence how much a company spends to acquire new customers. Understanding these factors is crucial for businesses looking to optimize their marketing strategies and improve their bottom line.

Market Conditions, Customer Acquisition Cost

Market conditions play a significant role in determining CAC. Factors such as demand for the product or service, economic conditions, and overall industry growth can impact how much a company needs to invest in customer acquisition. For example, during times of high competition or economic downturns, businesses may need to spend more on marketing to attract customers, leading to higher CAC.

Competition

The level of competition in the market can also affect CAC. In highly competitive industries, companies may need to invest more in marketing and advertising to stand out from competitors and attract new customers. This increased competition can drive up CAC as businesses vie for the attention of potential customers.

Industry Trends

Keeping up with industry trends is essential for managing CAC effectively. As consumer preferences and behaviors evolve, businesses must adapt their marketing strategies to remain relevant and attract new customers. Failing to stay ahead of industry trends can result in higher CAC as companies struggle to reach their target audience.

Successful Strategies for Reducing CAC

There are several strategies that companies can implement to reduce CAC and improve their overall marketing efficiency. These include optimizing digital marketing campaigns, improving customer targeting, leveraging data analytics to track and measure campaign performance, and investing in customer retention strategies to increase customer lifetime value.

Relationship Between CAC and Customer Lifetime Value

Understanding the relationship between CAC and customer lifetime value is crucial for maximizing the return on investment in customer acquisition. By calculating the lifetime value of a customer and comparing it to the cost of acquiring that customer, businesses can determine the effectiveness of their marketing efforts. A lower CAC relative to customer lifetime value indicates a more sustainable and profitable customer acquisition strategy.

Methods to Calculate Customer Acquisition Cost

Calculating Customer Acquisition Cost is crucial for businesses to understand how much they are spending to acquire each new customer. There are different methods used to calculate this important metric, each with its own advantages and limitations.

Method 1: Cost Per Acquisition (CPA)

- The CPA method calculates the total cost of acquiring a customer by dividing the total marketing expenses by the number of customers acquired.

- This method is straightforward and easy to understand, making it a popular choice for many businesses.

- However, it may oversimplify the calculation by not accounting for other factors that contribute to customer acquisition.

Method 2: Customer Lifetime Value (CLV)

- The CLV method calculates the Customer Acquisition Cost by comparing the cost of acquiring a customer to the revenue generated from that customer over their lifetime.

- This method provides a more comprehensive view of customer acquisition costs and helps businesses make more informed decisions.

- However, it can be complex to calculate and may require sophisticated data analysis.

Step-by-Step Guide to Calculate Customer Acquisition Cost using CPA Method

- Identify all marketing expenses incurred during a specific period.

- Determine the number of customers acquired during the same period.

- Divide the total marketing expenses by the number of customers acquired to get the Cost Per Acquisition.

- For example, if you spent $10,000 on marketing and acquired 100 customers, your Customer Acquisition Cost using the CPA method would be $100.

Real-Life Case Study: Company XYZ

“Company XYZ accurately calculated their Customer Acquisition Cost using the CLV method and discovered that they were spending more to acquire customers than the revenue generated from them. This prompted the company to shift their marketing strategies and focus on high-value customers, leading to a significant increase in profitability.”

Improving Customer Acquisition Cost Efficiency

When it comes to optimizing Customer Acquisition Cost (CAC) efficiency, businesses need to focus on various strategies to reduce costs and maximize ROI. By implementing the right tactics, companies can enhance their marketing and sales efforts to acquire customers more effectively and efficiently.

Utilize Targeted Marketing Campaigns

One way to improve CAC efficiency is by targeting specific audience segments with personalized marketing campaigns. By tailoring messages and offers to the needs and preferences of potential customers, businesses can increase conversion rates and reduce acquisition costs.

Invest in Customer Retention

Another effective strategy is to invest in customer retention programs to increase lifetime value and reduce the need for constant acquisition efforts. By focusing on building long-term relationships with existing customers, businesses can lower overall CAC and improve profitability.

Implement Marketing Automation

Using marketing automation tools can also help streamline processes, improve lead nurturing, and enhance overall campaign efficiency. By automating repetitive tasks and workflows, businesses can save time and resources while increasing conversion rates and reducing CAC.

Utilize Data Analytics

By leveraging data analytics and customer insights, businesses can make informed decisions to optimize marketing and sales strategies. Analyzing key metrics and performance indicators can help identify areas for improvement and adjust tactics to reduce CAC while increasing customer acquisition.

Embrace Innovative Technologies

Exploring new technologies such as artificial intelligence, machine learning, and predictive analytics can provide valuable insights and opportunities to enhance CAC efficiency. By staying current with technological advancements, businesses can gain a competitive edge and improve their overall customer acquisition processes.