Investing for Beginners introduces the world of finance in a way that’s easy to understand and exciting to explore. From understanding investments to developing strategies, this guide is your gateway to financial empowerment.

Understanding Investment

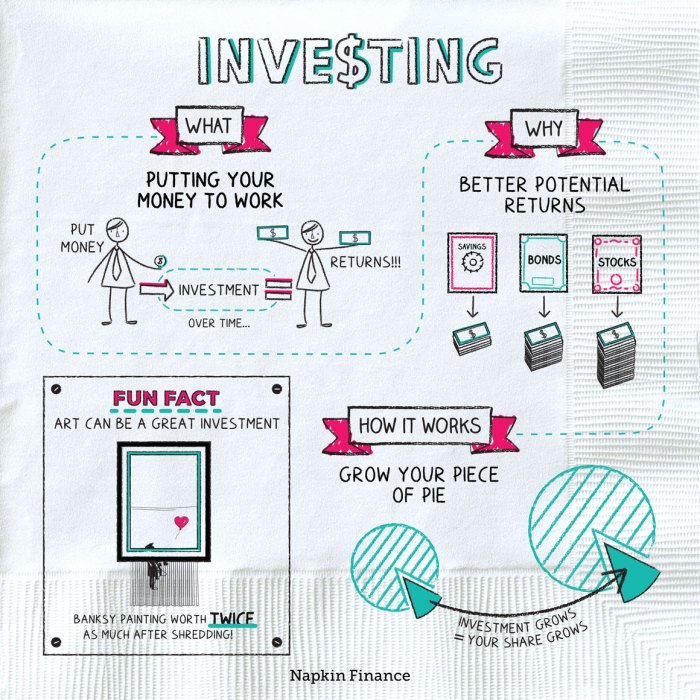

Investing is the act of allocating funds into assets with the expectation of generating profitable returns in the future. It involves purchasing financial products such as stocks, bonds, real estate, or mutual funds with the goal of increasing wealth over time.

Importance of Investing for Beginners

Investing is crucial for beginners as it allows them to grow their money and achieve financial goals. By investing early, individuals can take advantage of compound interest, which can significantly boost their returns over time. It also acts as a hedge against inflation, ensuring that the value of money does not erode over the years.

Types of Investments, Investing for Beginners

- Stocks: Ownership in a company, providing potential capital appreciation and dividends.

- Bonds: Loans made to governments or corporations, offering fixed interest payments.

- Real Estate: Ownership of property, offering rental income and potential appreciation.

- Mutual Funds: Pooled funds from multiple investors, managed by professionals to achieve diversification.

Setting Financial Goals

Setting financial goals is a crucial step in the investing process. It involves determining what you want to achieve with your investments and establishing a roadmap to reach those objectives. By setting clear financial goals, you can stay focused, motivated, and make informed decisions when it comes to investing your money.Identifying short-term and long-term financial goals is essential for creating a well-rounded investment strategy.

Short-term goals typically involve saving for emergencies, paying off debt, or making a large purchase in the near future. Long-term goals, on the other hand, may include retirement planning, buying a home, or funding a child’s education.

Aligning Investment Strategies with Financial Goals

When aligning investment strategies with financial goals, it is important to consider the time horizon, risk tolerance, and return expectations associated with each goal. Here are some tips to help you align your investment strategies with your financial goals:

- Assess your risk tolerance: Understand how much risk you are willing to take on each investment based on your comfort level and financial situation.

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk and optimize returns.

- Set realistic expectations: Be realistic about the returns you can expect from your investments based on historical performance and market conditions.

- Review and adjust regularly: Regularly review your investment portfolio to ensure it aligns with your financial goals and make adjustments as needed.

Risk Management

Investing always involves some level of risk. Risk refers to the possibility of losing money on an investment due to various factors such as market fluctuations, economic conditions, or company performance. It is essential for investors, especially beginners, to understand and manage these risks effectively.Diversification plays a crucial role in managing risk when investing. By spreading investments across different asset classes, industries, or geographical regions, investors can reduce the impact of a potential loss in any single investment.

This strategy helps minimize the overall risk in a portfolio and protect against significant losses.

Importance of Diversification

Diversification is key to reducing the impact of market volatility and unforeseen events on an investment portfolio. By not putting all your eggs in one basket, you can mitigate the risk of a single investment significantly affecting your overall financial health. It is a fundamental principle in risk management for investors of all levels.

- Diversify across asset classes: Invest in a mix of stocks, bonds, real estate, and other assets to spread risk.

- Consider diversifying within asset classes: Choose investments from different industries or sectors to avoid concentration risk.

- Rebalance your portfolio regularly: Periodically review and adjust your investments to maintain diversification and manage risk effectively.

Remember, don’t put all your money in one investment. Diversification is the key to managing risk and protecting your financial future.

Investment Options

When it comes to investing, there are various options available for beginners to consider. Each investment option has its own set of pros and cons, and it’s important to understand them before making a decision. Let’s explore some of the most common investment options: stocks, bonds, mutual funds, and real estate.

Stocks

Stocks represent ownership in a company and can offer high returns, but they also come with a higher level of risk. It’s essential to research and choose individual stocks wisely to maximize potential gains.

Bonds

Bonds are debt securities issued by governments or corporations. They are considered safer than stocks but typically offer lower returns. Bonds can be a good option for investors looking for more stability in their portfolio.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer instant diversification and are managed by professionals, making them a convenient option for beginners.

Real Estate

Investing in real estate involves purchasing physical properties like houses, apartments, or commercial buildings. Real estate can provide both rental income and potential appreciation in value over time. However, it requires more hands-on management compared to other investment options.

Research and Analysis

Research and analysis play a crucial role in making informed investment decisions. By conducting thorough research and analysis, investors can better understand the market, assess potential risks, and identify profitable opportunities.

Importance of Research

- Research helps investors gain insights into the financial performance and stability of companies.

- It allows investors to stay informed about market trends, economic indicators, and industry developments.

- Research helps in evaluating the potential risks and rewards associated with different investment options.

Tools and Resources for Beginners

- Online brokerage platforms provide access to research reports, financial news, and analysis tools.

- Financial websites and blogs offer valuable insights, market updates, and investment tips for beginners.

- Investment podcasts and webinars can also be great resources for learning about research techniques and analysis methods.

Tips for Analyzing Investment Opportunities

- Consider the company’s financial health, growth potential, and competitive advantage in the market.

- Look at historical performance, future projections, and analyst recommendations to assess the investment opportunity.

- Diversify your portfolio to reduce risk and maximize returns by investing in a mix of asset classes and industries.

Investment Strategies: Investing For Beginners

Investment strategies are essential for beginners to understand in order to make informed decisions about their investments. Different strategies like buy and hold, dollar-cost averaging, and value investing can help individuals achieve their financial goals while managing risks effectively.

Buy and Hold

- Buy and hold is a long-term investment strategy where investors purchase securities and hold onto them for an extended period, regardless of short-term market fluctuations.

- Principle: This strategy is based on the belief that over time, the market will increase in value, providing a good return on investment.

- Example: An investor buys shares of a reputable company and holds onto them for several years, benefiting from the company’s growth and dividend payments.

Dollar-Cost Averaging

- Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the security’s price.

- Principle: This strategy helps reduce the impact of market volatility by spreading out the investment over time, potentially lowering the average cost per share.

- Example: An investor invests $100 every month in a mutual fund, buying more shares when prices are low and fewer shares when prices are high.

Value Investing

- Value investing focuses on buying undervalued securities that have the potential to increase in value over time.

- Principle: This strategy involves conducting thorough research to identify companies trading below their intrinsic value, aiming to benefit from future price appreciation.

- Example: An investor analyzes financial statements and market trends to identify a stock selling below its fair value, expecting it to increase in price once the market recognizes its true worth.